CHAPTER 13 BANKRUPTCY ATTORNEY

Las Vegas Chapter 13 Lawyer

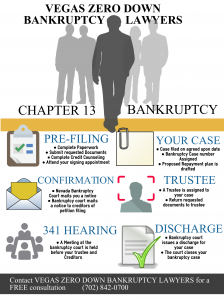

Chapter 13 Bankruptcy

Phoenix Chapter 13 Bankruptcy Attorneys

When you are facing bankruptcy, there are sure to be questions. Filing a Chapter 13 Bankruptcy in Phoenix is a major decision. However, a Ch 13 filing can be a beneficial debt relief tool. In a chapter 13 you can save your home from foreclosure, make up back mortgage payments, and it is all within a repayment plan that is curtailed for you to afford.

Additionally, declaring Chapter 13 bankruptcy in Phoenix can assist you in reducing or eliminating your debt, including: medical debt, utility payments, unsecured debt, credit card debt, and various types of loans. Plus, you can catch up on back tax debt, child support arrearages, and mortgage delinquencies.

Automatic Stay in Chapter 13 Bankruptcy

Also, an Automatic Stay provides protection from collections. Once you file for Chapter 13 protection in Phoenix, Arizona, an automatic stay will be go into place and your creditors must stop all collection processes against you. The Automatic Stay is a very powerful tool. Not only does it stop creditors and collection action, it can also stop a garnishment, save the family home, and allow you to protect your property from being repossessed.

Advantages and Disadvantages of filing Chapter 13 Bankruptcy

-Your debts will be reorganized into one convenient payment plan; a Chapter 7 requires no repayment of debts

-A Chapter 13 lasts 3-5 years, while a Chapter 7 only lasts 3-5 months. Depending on your situation, you may want your bankruptcy completed as soon as possible, or you might want the protections provided by the Automatic Stay for as long as possible.

-A Chapter 13 remains on your credit for 7 years after filing; a Chapter 7 remains on your credit for 10 years.

-If you are behind on your car or house payments, a Chapter 13 will spread out the past-due balance over 3-5 years; you will only have 3-5 months to catch up on your payments in a Chapter 7.

-You can keep your property in a Chapter 13; you can only keep property that falls under your state’s exemptions in a Chapter 7.

What Chapter 13 Can Do that Chapter 7 Can’t

Chapter 13 reorganizes any arrearages on your mortgage, car loan, income taxes, child support, and alimony over the course of your plan, while you would have to settle those past-due balances separately in a Chapter 7. You would also have to satisfy some of those debts before your Chapter 7 is completed to avoid foreclosure, repossession, etc.

If you have co-signers on financed properties such as your vehicle, surrendering that vehicle in Chapter 7 or losing it to repossession can negatively impact your cosigner. Chapter 13 protects your cosigners from negative credit reporting and collection attempts by your creditors.

Chapter 13 provides the unique opportunity of lien-stripping. If you owe more on your home than what it is worth, you can discharge secondary mortgages in your bankruptcy. You will not have this option in a Chapter 7.