Bankruptcy and Your Credit Score

How Filing Chapter 7 or Chapter 13 Impacts Your Credit

If you are in Las Vegas or Henderson, NV and recently filed bankruptcy, you may wonder if there is going to be an impact on your credit score. If you’ve previously filed for bankruptcy or consider filing, the impact it might have on the credit report of yours might raise some issues.

If you are in Las Vegas or Henderson, NV and recently filed bankruptcy, you may wonder if there is going to be an impact on your credit score. If you’ve previously filed for bankruptcy or consider filing, the impact it might have on the credit report of yours might raise some issues.

Bankruptcy is going to impact the credit report of yours. For just how long depends upon the kind of bankruptcy you file, based on articles in MoneyWise.

When you are filing as a person, you might file for Chapter seven or maybe Chapter thirteen. Figuring out what type best suits your needs is determined by just how much debt you owe and what serotonin you are in a position to spend.

Effect of Chapter seven bankruptcy

Chapter seven bankruptcy is better utilized whether you either default or even become unable to pay the creditors of yours. It generally is true for credit card debt, private loans, and medical bills. It does not, nonetheless, apply to pupil loans, alimony, criminal fines, taxes, or maybe kid support.

After filing for Chapter seven, the debt of yours may be totally wiped out, though it might have a negative impact on the credit report of yours for as much as ten years. The score of yours may decrease by almost as 200 points, as well.

To be able to qualify for Chapter seven, you have to pass a means test, which weighs about the debt of yours with your property and income. Certain property and valuables assets could be liquidated paying back several of the debt. items that are Important required for day-to-day living, nonetheless, might be exempt.

Effect of Chapter thirteen bankruptcy

If you are making excessive money to qualify for Chapter seven, but are not able paying the creditors of yours in total, you might want to look at filing for Chapter thirteen.

This can remain on the credit report of yours for as much as 7 years, however. During this particular period, you won’t be qualified for other bank loan, unless you first file a movement and get authorization out of the court.

Chapter thirteen bankruptcy calls for you to create month payments over the course of 3 to 5 years while holding onto assets and home.

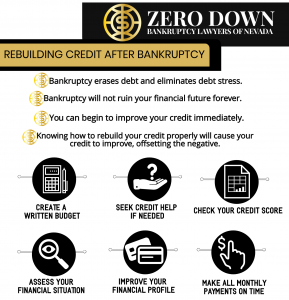

Can it be possible to reduce the effect of bankruptcy?

While there’s no minimum length of time for bankruptcy to remain on the credit report of yours, lessening the impact or maybe duration is unlikely. Bankruptcy is only able to stay on the credit report of yours for as much as ten years, however.

Check Your Credit Report After Filing Bankruptcy

What you are able to do, after filing for bankruptcy, is study the credit report of yours for errors. This may include inaccuracies regarding the private information of yours, creditors, debts, and timelines. When you find whatever that’s incorrect, you might file a dispute with the credit bureau of yours. If the bureau finds some errors in the bankruptcy of yours, it may possibly be removed from the report of yours.

What you are able to do, after filing for bankruptcy, is study the credit report of yours for errors. This may include inaccuracies regarding the private information of yours, creditors, debts, and timelines. When you find whatever that’s incorrect, you might file a dispute with the credit bureau of yours. If the bureau finds some errors in the bankruptcy of yours, it may possibly be removed from the report of yours.

When you do not find any mistakes, you are going to have to hold out the whole length of time for the bankruptcy to drop from the report of yours.

Get a “Fresh Start”

If you are unable to meet the obligations of yours to the creditors of yours, filing for bankruptcy is able to provide you with a clean economic start. Therefore, to discover more about the way the Nevada bankruptcy process works, talk to a seasoned bankruptcy lawyer. Our Vegas Bankruptcy Lawyers offer you a variety of debt relief options including: Vegas Zero Down Bankruptcy, Chapter 7 Bankruptcy, Chapter 13 Bankruptcy, Medical Bankruptcy, Emergency Bankruptcy, Stripping a Lien in a Chapter 13, Repossession Defense, Foreclosure Attorneys, Wage Garnishment Lawyers, and Bankruptcy by phone option.

Contact us for a FREE Consultation with one of our experienced Nevada bankruptcy attorneys. Our consults are either by phone or in our Vegas Bankruptcy Office. Call (702) 842-0700